I discussed the origins of our health insurance benefits in my last post. This is how it all fell apart.

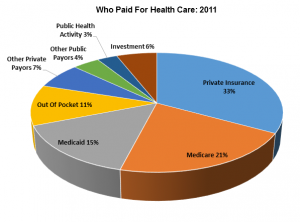

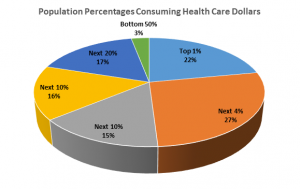

By 1960 employer-sponsored health insurance plans covered 142 million people just waiting to be exploited. Congress and the states mandated coverage for health conditions, procedures and products, often because of lobbying efforts, not medical necessity. Out-of-pocket spending dropped from 48% of all health care costs in 1960s to 11.5% by 2009. Annual health care expenditures rose every year, outpacing general inflation. We spent $27 billion in 1960, $888 billion in 1993 and $2.8 trillion in 2012. Everyone was happy playing with someone else’s money.

But there is only so much money to go around.

Medicare financing concerns surfaced early. In 1967, the House Ways and Means Committee predicted Medicare would cost $12 billion by 1990, an estimate 10 times too low. Medicare expenditures were $98-110 billion by then (depending on who you ask), rising to $536 billion by 2012.

In 1992, the Health Care Financing Administration (now the Centers for Medicare and Medicaid Services) switched to the Resource Based Relative Value Scale (RBRVS) payment schedule, reimbursing hospitals a set amount based on Diagnosis-Related Groups (DRGs) rather than on length of stay or charges. Commercial insurers followed. No one wanted to lose money so physicians discharged patients “quicker and sicker” than before. But the rate of growth in health care costs dipped only slightly before rising once again; insurance premiums quickly followed.

Health Maintenance Organizations (HMOs) attracted employers with large groups of mostly healthy workers, promising to control health care costs with “managed care.” The reality, “managed cost,” created obstacles to potentially costly care with pre-authorizations, denials, and penalties for using “out-of-network” providers. The primary care physician became the beleaguered and much resented “gatekeeper,” pressured to forestall referrals or deny care outright. Patients and physicians rebelled, often resorting to litigation or ugly media campaigns forcing HMO administrators to approve payments for just about anything, including in-vitro fertilization.*

Private insurers eventually relented as well, but covered their losses by raising premiums every year. Employers who could afford to reluctantly went along; those who balked lost employees to other companies. Employers with a strong union presence—Pittston Coal, NYNEX, General Electric—faced expensive strikes over health care benefits. Employees didn’t care as long as premium hikes or the full cost of benefits weren’t coming out of their pockets. Large companies began to self-insure, taking their employees out of existing risk pools. Smaller firms dropped their policies, or in many cases, insurers dropped them.

The biggest blow to employer-sponsored health care benefits came in 1990 when the Financial Accounting Standards Board (FASB) ruled that, beginning in 1992, retiree health care liabilities had to be on corporate balance sheets, effectively reducing company assets and driving down share prices. The percentage of mid-sized and large firms offering retirees health care benefits went from 85.6% in 1980 to 37.1% in 2000.

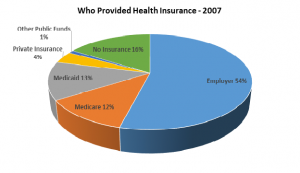

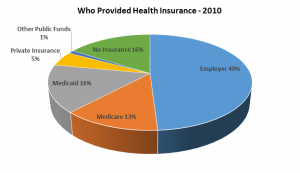

The dot-com bust in the late 1990s didn’t help. Employers reduced benefit packages, increased the employees’ share of their premium contribution, or dropped coverage altogether as the economy suffered. The percentage of employers offering health care benefits dropped from 80% in 1989 to 61% in 2013. Every year forty to fifty million people lacked health insurance. Health care premiums for a family policy almost tripled between 1999 and 2013, rising from $5,791 to $16,351. People expected health insurance to cover everything because it was so expensive. Health insurance was expensive because people expected it to cover everything.

So how do we fix it?

*In 1998 the Supreme Court’s ruling on Bragdon v. Abbott that being HIV positive constituted a disability and inferred that infertility was also a disability since, at the time, HIV positive women were advised against becoming pregnant. A similar ruling cost the City of Chicago $1.5 million to settle a class-action lawsuit brought by city workers demanding reimbursement for fertility treatments.